New York, NY – June 17, 2010 – (RealEstateRama) — PREET BHARARA, the United States Attorney for the Southern District of New York, GEORGE VENIZELOS, the Acting Assistant Director-in-Charge of the New York Field Division of the Federal Bureau of Investigation (“FBI”), NEIL BAROFSKY, the Special Inspector General of the Troubled Asset Relief Program (“SIGTARP”), RICHARD H. NEIMAN, the Superintendent of Banks for New York State (“NYSBD”), CHARLES R. PINE, the Special Agent-in-Charge of the New York Field Office of the Internal Revenue Service, Criminal Investigation Division (“IRS”), PHILIP R. BARTLETT, the Assistant Inspector-in-Charge of the New York Division of the United States Postal Inspection Service (“USPIS”) JON T. RYMER, the Inspector General for the Federal Deposit Insurance Corporation, Office of Inspector General (“FDIC-OIG”), KENNETH M. DONOHUE, the Inspector General of the Department of Housing and Urban Development, Office of Inspector General (“HUDOIG”), and BRIAN G. PARR, the Special Agent-in-Charge of the New York Field Office of the United States Secret Service (“USSS”), announced today the unsealing of charges against 38 defendants, in eight separate cases, for allegedly engaging in various mortgage fraud scams that collectively defrauded lenders out of over $29 million in home mortgage loans, and victimized hundreds of homeowners. Among those charged are three lawyers, seven mortgage brokers, three real estate agents, and two loan officers.

A/ADIC George Venizelos speaking at the press conference with United States Attorney Preet Bharara (far right) Photo Credit: Rebecca Callahan, FBI

In connection with the charges unsealed today, 32 defendants have been arrested or are expected to surrender to authorities. The defendants taken into custody today in the New York area are expected to be presented in Manhattan federal court later this afternoon. Six defendants are still at large.

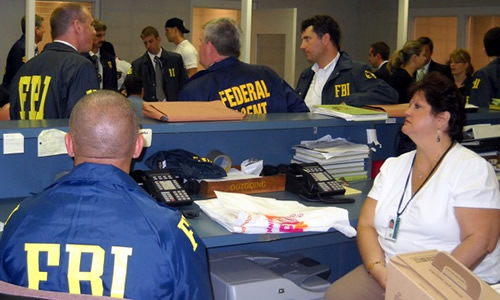

FBI personnel at work in arrest processing facility

Photo Credit: Rich Kolko, FBI

The mortgage fraud scams alleged in the cases announced today include, among other things, the use of counterfeit documents to obtain loans, the use of straw buyers with falsely inflated income and employment information, obtaining loans to purchase properties that did not exist, and bogus loan modification programs falsely promising Federal stimulus aid to distressed homeowners who were having difficulties meeting their mortgage payments. The frauds targeted numerous financial institutions and hundreds of ordinary homeowners, and netted an aggregate of over $29 million in fraudulent loans.

The charges announced today are part of the coordinated nationwide sweep dubbed “Operation Stolen Dreams,” announced today by Attorney General ERIC HOLDER, in which federal and state law enforcement officers across the country have targeted mortgage fraud from March 1, 2010, to June 18, 2010. During this period of time, 55 defendants were charged in the Southern District of New York, involving over $45 million in fraudulent loans.

Attorney General ERIC HOLDER stated: “Mortgage fraud ruins lives, destroys families and devastates whole communities, so attacking the problem from every possible direction is vital. We will use every tool available to investigate, prosecute, and prevent mortgage fraud, and we will not rest until anyone preying on vulnerable American homeowners is brought to justice.

PREET BHARARA, the United States Attorney for the Southern District of New York, said: “We are in the midst of a recovery from one of the worst financial crises this country has ever seen. Financial fraud on the scale we allege today poses a serious threat to the recovery, since it harms hard-working Americans and threatens to erode the public’s confidence in the credit markets. Mortgage fraudsters can be as clever as chameleons—adapting their schemes to stay one step ahead of law enforcement. But today we have caught up with them. Since starting as U.S. Attorney, I have made these types of cases a priority for the Southern District of New York, by creating the Complex Frauds Unit to combat financial fraud in all sectors. In only nine months, the Complex Frauds Unit has brought mortgage fraud-related charges against over 100 defendants. The message from today’s enforcement action is clear: If you are thinking about targeting the vulnerable through some sort of get rich quick scheme, think again. Odds are you will be caught, arrested, and brought to justice.”

GEORGE VENIZELOS, the Acting Assistant Director-in-Charge of the New York Field Division of the FBI, stated: “The FBI remains determined to ferret out fraud in the mortgage market. The schemes of these defendants resulted in tens of millions of dollars in losses to legitimate lenders—and ill-gotten gains for themselves. The ingenuity of many of these defendants was outstripped only by their audacity and brazenness. But being clever enough to pull it off isn’t the same as being able to get away with it. Vigorous policing of fraud will not only punish the swindlers and prevent unjust enrichment, but it will also protect legitimate home buyers as well as lenders.”

NEIL BAROFSKY, the Special Inspector General of SIGTARP, stated: “The United States Government’s response to the foreclosure crisis includes programs to support struggling homeowners by modifying their mortgages at no expense to the borrowers. By engaging in the conduct described in the charges announced today, fraudsters hurt not only their direct victims, but also the credibility of the Government’s relief efforts. Such conduct will not go unpunished. SIGTARP is committed to working with its law enforcement partners to bring to justice each and every criminal who seeks to profit from this national crisis.”

RICHARD H. NEIMAN, the Superintendent of Banks for New York State, stated: “Consumers need to have confidence that all financial institutions and industry members are playing by the rules. Just as the federal regulatory reforms that are being debated in Congress are essential to preventing future crises, law enforcement efforts by state and federal agencies are essential to restoring and maintaining public confidence in our financial system. Today we are sending a strong message to both the industry and New York consumers that we will use the full power of the law—whether it be writing new regulations or enforcing existing ones—to ensure that the public is protected.”

CHARLES R. PINE, the Special Agent-in-Charge of the New York Field Office of the IRS, stated: “Those who engage in mortgage fraud and related criminal activity victimize the American public by negatively impacting the economy. IRS Criminal Investigation will continue to be an active participant in this invaluable Task Force to protect our citizens from the impacts of mortgage fraud and bring those to justice who commit tax evasion, money laundering or related financial crimes.”

PHILIP R. BARTLETT, the Assistant Inspector-in-Charge of the New York Division of USPIS, stated: “The Postal Inspectors are proud to work with the U.S. Attorney and other agencies to combat mortgage fraud here in New York and in other communities.”

JON T. RYMER, the Inspector General for the FDIC, stated: “The Federal Deposit Insurance Corporation Office of Inspector General is committed to its partnerships with others in the law enforcement community as we address mortgage fraud cases throughout the country. The American people need to be assured that their government is working to ensure integrity in the financial services and housing industries and that those involved in criminal activites that undermine that integrity will be held accountable.”

KENNETH M. DONOHUE, the Inspector General of HUD-OIG, stated: “The last number of years have seen enormous and damaging developments in the mortgage and housing markets with an urgent reliance on the government to bolster unstable marketplaces and devastated communities. The HUD OIG, in partnership with other federal agencies, is deeply committed to ensuring that scarce resources are not diverted to those who seek to enrich themselves at the expense of those who so desperately need assistance today.”

BRIAN G. PARR, the Special Agent-in-Charge of the New York Field Office of USSS, stated: “The U.S. Secret Service is proud to have participated in Operation Stolen Dreams, with our dedicated agents pursuing criminal investigations into mortgage fraud violations, which have culminated in the successful federal indictments of individuals in our district. Cooperation and partnerships such as these consistently allow us to focus our resources to uncover and prevent criminal activity more efficiently than ever.”

The Cases

The cases announced today are described in greater detail below. The charges against each defendant and the corresponding maximum potential penalties are contained in charts attached to this press release. According to the charging instruments unsealed today in Manhattan federal court:

United States v. Wilfredo Blas, et al.

Seventeen defendants are charged in a three-count Complaint with perpetrating a scheme involving over $15 million in fraudulent loans using fake pay stubs, W-2 forms, and tax returns. The investigation began in 2008, when the FBI learned that a corrupt tax preparer was selling fake documents to mortgage brokers, real estate agents, and others, who then used the documents to support fraudulent mortgage loan applications.

In July 2009, the FBI executed a search warrant at the tax preparer’s Corona, New York, business, and recovered a computer containing a cache of false documents in electronic form, including: approximately 1,161 phony pay stubs; approximately 38 phony IRS form W-2s; and 148 phony Federal income tax returns, which were denoted as false by the use of the letter “f” in the file name on the tax preparer’s computer. The computer also contained a “macro” that created templates for false pay stubs. In addition, the FBI recovered from the business handwritten notes that had been provided to the corrupt tax preparer, with instructions on what information to include in the false documents.

The corrupt tax preparer became an FBI informant, and agreed to permit the FBI to record and videotape his interactions with the individuals to whom he sold false documents. Over the next several months, the informant had the recorded meetings with many of the defendants, during which defendants negotiated and purchased false documents from the informant. The defendants then used these false documents to obtain fraudulent mortgage loans, often in the names of straw buyers—persons who were paid to act as nominal purchasers of the properties, but who never intended to live in them. The phony documents were used to support false representations in the loan applications about the straw buyers’ employment, income, and creditworthiness. Some of the defendants even paid the informant to falsely state that straw buyers were employed by the informant’s tax preparation business. The defendants used these methods to fraudulently obtain loans with a face value estimated at over $15 million. However, this figure accounts for only a fraction of the over 1,300 false documents recovered from the tax preparer/informant’s computer. And the investigation of what was done with these documents is very much ongoing.

The defendants include:

WILFREDO BLAS, who is alleged to have submitted false documents purchased from the informant in support of fraudulent loan applications, and to have recruited straw purchasers. BLAS is also alleged to have instructed a straw purchaser to lie to law enforcement authorities about the mortgage fraud scheme;

NIDIA CAMPOS and OSCAR OSORIO, who were associated with the businesses Telemundo Realty and NG Second Chance Homes, and who are alleged to have submitted false documents purchased from the informant in connection with a mortgage loan application;

JOHN ISOLA, who is alleged to have submitted false documents purchased from the informant in connection with two fraudulent loan applications, and to have acted as a straw purchaser for the two properties related to these loans;

JOSE ROSARIO and PATRICIA GONZALEZ, employees of the Queens mortgage brokerage Jet Funding, who are alleged to have submitted false documents purchased from the informant in connection with multiple fraudulent loan applications;

CURTIS MCPHERSON, an employee of Parkview Mortgage, a mortgage brokerage in Malverne, New York, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan. MCPHERSON also allegedly attempted to purchase from the informant the computer software that the informant used to create fraudulent paystubs;

UMER RAJA, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan, which he then used to purchase a property he would not otherwise have been able to purchase;

MOHAMMED ISLAM, an employee of Rising Realty, a real estate agency located in Jackson Heights, New York, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan application;

MARIA ZAPATA, a Wells Fargo Home Mortgage Consultant and Loan Officer, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan application, and to have falsified a Verification of Employment form, submitted to Wells Fargo;

EDWIN BARRERA, a mortgage broker at Northpoint Mortgage in Queens, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan application;

MARLOWN CASO, a/k/a “Marlo Castro,” a/k/a “Marlo Caso,” a real estate broker, who is alleged to have submitted false documents purchased from the informant in connection with a mortgage loan application, and to have recruited at least one straw purchaser;

MOISES VARGAS, a loan officer at Gotham City Mortgage in Jackson Heights, who is alleged to have paid the informant to provide a lender with false employment information on behalf of a borrower, one of VARGAS’s relatives;

ROMANA GALEZO and GALO HUAYCOCHEA, who are alleged to have obtained documents containing fraudulent income and employment information and used that information in a home mortgage loan application;

JHOJANS ELEGANTE, a/k/a “Joseph Elegante,” a real estate agent for Elegante Properties, who is alleged to have obtained and submitted documents containing fraudulent income information in connection with a home mortgage refinancing application, submitted through the Government’s Making Home Affordable program, a plan to stabilize the housing market and help struggling homeowners avoid foreclosure, funded, in part, through the Troubled Asset Relief Program; and

ANTHONY REID, who is alleged to have obtained fraudulent documents and used them to obtain a business loan application.

All of the defendants except ELEGANTE are charged with Conspiracy to commit wire fraud and bank fraud. ELEGANTE is charged with major fraud against the United States in connection with a Federal stimulus program. In addition, BLAS is charged with witness tampering in connection with his having instructed the straw purchaser to lie to law enforcement authorities.

United States v. Jaime Cassuto, et al.

Three defendants, JAIME CASSUTO, DAVID CASSUTO, and ISAAK KHAFIZOV, are charged in a Complaint with one count of Conspiracy to commit mail and Wire fraud in connection with a mortgage modification scam. The defendants were principals of American Home Recovery (“AHR”), a mortgage modification company located in Manhattan. At the direction of the defendants, salespeople employed by AHR sent unsolicited letters and emails to homeowners who were having difficulty making their mortgage payments, offering AHR’s assistance in securing loan modifications. For a fee, AHR offered to renegotiate the terms of the homeowners’ mortgages, and obtain more favorable interest rates. AHR boasted a 98 percent success rate in loan modifications, and promised homeowners their money back if AHR was unable to successfully renegotiate the homeowners’ mortgages.

After collecting thousands of dollars in fees, AHR in fact did virtually nothing to renegotiate the homeowners’ mortgages. In some cases, AHR did not even contact the homeowners’ banks concerning the subject mortgages. Nor did AHR refund the fees as promised, but instead retained them for its own benefit. In June 2009, AHR transferred all of its unfulfilled mortgage modification orders—hundreds of them—to another individual, and told that individual that he could attempt to collect additional fees from the homeowners. In this way, the defendants and AHR defrauded over 240 homeowners out of approximately $500,000 in fees.

United States v. Dustin Dente, et al.

Four defendants, including two attorneys and two mortgage brokers, are charged in a thirteen-count Superseding Indictment with a multimillion-dollar mortgage fraud involving fourteen separate properties. DUSTIN DENTE was a real estate attorney with offices in Rosedale and Cold Spring Harbor. BRANDON LISI worked in DENTE’s law offices. In 2008, LISI became an attorney, but prior to that time had held himself out as an attorney. CHARLES ADESSI and RICH WILLIAMS were mortgage brokers working for DENTE.

The defendants are alleged to have obtained through fraud numerous home mortgage loans on at least fourteen properties, with a total face value of over $7.4 million. The defendants executed their scheme by recruiting straw buyers to act as nominal borrowers, and then submitting loan applications falsely inflating the straw buyers’ income and creditworthiness. The loan applications also falsely stated that straw buyers intended to live in the mortgaged properties, when in fact they never intended to do so, and were only acting as nominal purchasers in exchange for a fee paid by the defendants. In most instances, the defendants used these methods to fraudulently obtain loans in excess of the actual purchase prices of the properties, and then kept a portion of the loaned funds for their own benefit. In addition, in some instances, the property purchase that was supposed to be funded by the loans never occurred, and the defendants simply pocketed the loaned proceeds without informing the lenders. Many of the loans fraudulently obtained by the defendants are now in default and/or foreclosure proceedings.

United States v. Verbelle Williams, et al.

Three defendants, including one attorney, are charged in a three-count Indictment with committing fraud in connection with obtaining at least $2.9 million in mortgage loans. The defendants executed the scheme by recruiting straw buyers to act as nominal purchasers for properties, promising them a fee of $5,000 to $15,000 per property. The defendants then prepared and submitted mortgage loan applications under the straw buyers’ names, which contained false personal and financial information, and employment information. In order to get loans at lower interest rates, the defendants also misrepresented that the straw buyers intended to live in the properties, when in fact they were only nominally the owners of the properties, and did not intend to live in them.

The defendants’ scheme also utilized fraudulent passthrough transactions that were not disclosed to the lenders to obtain loans in far greater amounts than they would otherwise have been able to obtain. These transactions involved structuring the purchase and sale of a mortgaged property so that the property would be sold twice on the same day—it would be bought by the defendants at a low price, and then re-sold, essentially back to the defendants, at a substantially higher price, enabling the defendants to obtain a loan at the higher sale price and pocket the difference. Often, this would be accomplished by having an entity the defendants controlled, or a straw buyer, make the first purchase, and then sell the property for hundreds of thousands of dollars more to another straw buyer controlled by the defendants. The defendants did not inform the lenders of the first purchase or the lower purchase price, and obtained a mortgage loan based on the second, higher purchase price. In this manner, the defendants were able to fraudulently obtain a mortgage loan at the higher purchase price, pay only the lower price for the property, and pocket the difference.

VERBELLE WILLIAMS, an attorney, acted at times as the lawyer for the straw buyers, the sellers, and lenders, and as the settlement agent at closings. CHUCK OSAKWE, the owner of First Line Enterprises, a mortgage brokerage company, located properties to use in the scheme, and recruited straw buyers. ONOCHIE ONOBOGU worked at WILLIAMS’ law office and at First Line, and acted as a straw buyer in the above-described pass-through transactions.

United States v. Paulette Gabbidon, et al.

Three defendants, PAULETTE GABBIDON, JASON LEWIS, and JOYCE LEWIS, are charged in a five-count Indictment with Conspiracy to commit bank fraud and bank fraud, in connection with a scheme to obtain mortgage loans on nonexistent properties. GABBIDON was associated with various mortgage businesses, including Mortgage Opt Corporation, Alliyah I Advisory Group, Alliyah I Property Management Group, and Alliyah Hibbert Incorporated, all located in the Southern District. The defendants fraudulently obtained lines of credit on four properties they claimed were located in Rockland County and New Jersey. In support of these credit applications, the defendants submitted doctored appraisals and loan applications containing numerous misrepresentations. GABBIDON at times represented to the victim bank that she was an attorney, and provided a false name, in order to obtain control over the loan proceeds. The defendants obtained a total of over $1 million from the fraud.

United States v. Orit Tuil, et al.

Five defendants, ORIT TUIL, ANNETTE SHERESHEVSKY FONTE, DARLENE RITTER, NIR ZEER, and JOAN POWELL, are charged in a onecount Complaint with Conspiracy to commit wire fraud, in connection with a scheme to obtain more than $1.6 million in mortgage loans on three properties in Brooklyn and Queens, New York. TUIL, RITTER, and POWELL, who all held themselves out as real estate agents, executed the scheme, in order to generate fees and other profits for themselves, by recruiting straw purchasers to buy certain properties using an uncharged coconspirator as a mortgage broker. They then submitted loan applications on behalf of the purchasers that falsely inflated the straw buyers’ income, assets, and/or creditworthiness, among other things, in order to induce the banks to fund the mortgage loans. For two of the transactions, in exchange for a fee, SHERESKEVSKY FONTE, who worked at a national bank, provided fraudulent verifications of deposits that inflated the assets of the purchasers. ZEER acted on behalf of the seller for one of the properties and falsely represented that he was giving a gift of $23,000 in cash to the purchaser, which in fact he did not give.

United States v. Yevgeny Komar and Joseph Patton

YEVGENY KOMAR and JOSEPH PATTON are charged in a twocount Complaint with Conspiracy to commit wire fraud, in connection with their participation in a scheme to defraud investors in a partnership that was supposed to build and develop a residential property in Brooklyn, New York. KOMAR and PATTON made numerous misrepresentations about the status of the project in order to induce approximately 16 individuals to invest about $471,000 in the project, and they then used the proceeds for their own purposes. KOMAR is also charged with one count of bank fraud in connection with his use of a straw purchaser to obtain a $520,000 loan to purchase the location upon which the investment partnership was purportedly going to build. The loan application submitted by KOMAR in fact contained false information about the purchaser’s income and assets, among other things.

United States v. Deanyon Ross

DEANYON ROSS is charged in a one-count Complaint with Conspiracy to commit bank fraud, in connection with a scheme to defraud lenders out of approximately $1 million in mortgage loans. ROSS and co-conspirators at Poui Land Services, LLC, a title company, submitted loan applications using straw purchasers and false information about the purchasers’ creditworthiness, purchased properties and then stripped them of their equity, and in some instances re-sold, or “flipped,” the properties to straw purchasers, for whom the defendants obtained mortgage loans using false income, employment, and other financial information. ROSS recruited straw buyers for the properties, and further posed as a landlord to falsely verify rental payments made by a straw purchaser.

The charges unsealed today as part of “Operation Stolen Dreams” are the culmination of a series of investigations conducted by the United States Attorney’s Office for the Southern District of New York, the FBI, NYSBD, SIGTARP, IRS, HUD-OIG, USPIS, FDIC-OIG, and USSS.

Mr. BHARARA thanked all of the federal, state, and local law enforcement agencies involved in the investigation for their outstanding work. Mr. BHARARA also thanked the Federal Reserve Bank of New York, the High Intensity Financial Crimes Area (“HIFCA”) Task Force, the Suffolk County District Attorney’s Office, and the United States Attorney’s Office Investigators, for their invaluable assistance. Mr. BHARARA added that the investigation is continuing.

This case was brought in coordination with President BARACK OBAMA’s Financial Fraud Enforcement Task Force, on which Mr. BHARARA serves as Co-Chair of the Securities and Commodities Fraud Working Group and Mr. BAROFSKY serves as Co-Chair of the Rescue Fraud Working Group. President OBAMA established the interagency Financial Fraud Enforcement Task Force to wage an aggressive, coordinated, and proactive effort to investigate and prosecute financial crimes. The task force includes representatives from a broad range of federal agencies, regulatory authorities, inspectors general, and state and local law enforcement who, working together, bring to bear a powerful array of criminal and civil enforcement resources. The task force is working to improve efforts across the federal executive branch, and with state and local partners, to investigate and prosecute significant financial crimes, ensure just and effective punishment for those who perpetrate financial crimes, combat discrimination in the lending and financial markets, and recover proceeds for victims of financial crimes.

The prosecution of the cases arising from “Operation Stolen Dreams” is being overseen by the Office’s Complex Frauds Unit. The prosecution of United States v. Wilfredo Blas, et al. is being handled by Assistant United States Attorneys AMANDA KRAMER and SEAN BUCKLEY. The prosecution of United States v. Jaime Cassuto, et al., is being handled by Assistant United States Attorneys NICOLE FRIEDLANDER and NIKETH VELAMOOR. The prosecution of United States v. Dustin Dente, et al. is being handled by Assistant United States Attorneys SEETHA RAMACHANDRAN and MICHAEL LOCKARD. The prosecution of United States v. Verbelle Williams, et al. is being handled by Assistant United States Attorneys KAN NAWADAY and LEE RENZIN. The prosecution of United States v. Paulette Gabbidon, et al. is being handled by Assistant United States Attorneys MARGERY FEINZIG, MARCIA COHEN, and SARAH KRISSOFF. The prosecution of United States v. YEVGENY KOMAR and JOSEPH PATTON is being handled by Assistant United States Attorney SEAN BUCKLEY. The prosecution of United States v. ORIT TUIL, et al. is being handled by Assistant United States Attorneys SARAH MCCALLUM and SEAN BUCKLEY. The prosecution of United States v. Deanyon Ross is being handled by Assistant United States Attorney JENNIFER BURNS.

If you believe you were a victim of these crimes, including a victim entitled to restitution, and you wish to provide information to law enforcement and/or receive notice of future developments in the case or additional information, please contact Wendy Olsen-Clancy, the Victim Witness Coordinator at the United States Attorney’s Office for the Southern District of New York, at (866) 874-8900, or Wendy.Olsen (at) usdoj (dot) gov. For additional information, go to: http://www.usdoj.gov/usao/nys/victimwitness.html.

The charges contained in the various charging instruments discussed above are merely accusations, and the defendants are presumed innocent unless and until proven guilty.

CONTACT:

| FBI JIM MARGOLIN, RICHARD KOLKO (212) 384-2720, 2715NYSBD GLORIMAR PEREZ-GONZALEZ (212) 709-1691USPIS THOMAS BOYLE (212) 330-3049HUD-OIG RENE FEBLES (212)542-7950 |

SIGTARP KRIS BELISLE (202) 927-8940IRS JOSEPH FOY (212) 436-1032FDIC-OIG A. DEREK EVANS (917) 320-2560USSS PEDRO ESCANDON (718) 840-1144 |

| Defendant | Residence | Age |

|---|---|---|

| WILFREDO BLAS | Long Beach, New York | 41 |

| NIDIA CAMPOS | Jamaica, New York | 60 |

| OSCAR OSORIO | Hempstead, New York | 55 |

| JOHN ISOLA | Dingman’s Ferry, Pennsylvania | 57 |

| JOSE ROSARIO | East Elmhurst, New York | 47 |

| PATRICIA GONZALEZ | East Elmhurst, New York | 39 |

| CURTIS MCPHERSON | East Elmhurst, New York | 35 |

| UMER RAJA | Huntington Station, New York | 35 |

| MOHAMMED ISLAM | Bronx, New York | 42 |

| MARIA ZAPATA | Rosedale Village, New York | 41 |

| EDWIN BARRERA | Floral Park, New York | 35 |

| MARLOWN CASO | East Elmhurst, New York | 34 |

| MOISES VARGAS | East Elmhurst, New York | 46 |

| ROMANA GALEZO | Astoria, New York | 58 |

| GALO HUAYCOCHEA | Astoria, New York | 61 |

| JHOJANS ELEGANTE | Freeport, New York | 47 |

| ANTHONY REID | Saint Albans, New York | 50 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Bank Fraud and Wire Fraud | WILFREDO BLAS NIDIA CAMPOS OSCAR OSORIO JOHN ISOLA PATRICIA GONZALEZ CURTIS McPHERSON UMER RAJA MOHAMMED ISLAM MARIA ZAPATA EDWIN BARRERA MARLOWN CASO MOISES VARGAS ROMANA GALEZO GALO HUAYCOCHEA ANTHONY REID |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; and restitution |

| 2 | Major Fraud Against the United States | JHOJANS ELEGANTE | 10 years in prison; fine of $1,000,000; and restitution |

| 3 | Witness Tampering | WILFREDO BLAS | 20 years in prison; fine of $250,000 or twice the gross gain or loss |

United States v. Jaime Cassuto, et al.

| Defendant | Residence | Age |

|---|---|---|

| JAIME CASSUTO | Seaford, New York | 40 |

| DAVID CASSUTO | Massapequa, New York | 36 |

| ISAAK KHAFIZOV | Howard Beach, New York | 23 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Mail Fraud and Wire Fraud | JAIME CASSUTO DAVID CASSUTO ISAAK KHAFIZOV |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; and restitution |

United States v. Dustin Dente, et al.

| Defendant | Residence | Age |

|---|---|---|

| DUSTIN DENTE | West Islip, New York | 38 |

| BRANDON LISI | Dix Hills, New York | 36 |

| CHARLES ADESSI | Manalapan, New Jersey | 49 |

| RICHARD WILLIAMS | Hempstead, New York | 37 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Bank Fraud and Wire Fraud | DUSTIN DENTE BRANDON LISI CHARLES ADESSI RICH WILLIAMS |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 2 | Bank Fraud | DUSTIN DENTE BRANDON LISI |

30 years in prison; fine of $250,000 or twice the gross gain or loss; restitution and forfeiture |

| 3 | Bank Fraud | DUSTIN DENTE BRANDON LISI |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 4 | Wire Fraud | DUSTIN DENTE BRANDON LISI |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 5 | Bank Fraud | DUSTIN DENTE BRANDON LISI |

30 years in prison; fine of $1,000,000 or twice the gross gain or less; restitution and forfeiture |

| 6 | Bank Fraud | DUSTIN DENTE BRANDON LISI |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 7 | Wire Fraud | DUSTIN DENTE BRANDON LISI RICH WILLIAMS |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 8 | Bank Fraud | DUSTIN DENTE BRANDON LISI RICH WILLIAMS |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 9 | Wire Fraud | DUSTIN DENTE BRANDON LISI RICH WILLIAMS |

20 years in prison; fine of $250,000 or twice the gross gain or loss; restitution and forfeiture |

| 10 | Wire Fraud | DUSTIN DENTE BRANDON LISI CHARLES ADESSI |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 11 | Wire Fraud | DUSTIN DENTE BRANDON LISI CHARLES ADESSI |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 12 | Bank Fraud | DUSTIN DENTE BRANDON LISI |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

| 13 | Wire Fraud | DUSTIN DENTE BRANDON LISI |

20 years in prison; fine of $1,000,000 or twice the gross gain or loss; restitution and forfeiture |

United States v. Verbelle Williams, et al.

| Defendant | Residence | Age |

|---|---|---|

| VERBELLE B. WILLIAMS | Hempstead, New York | 57 |

| CHUKWUMA OSAKWE | Bay Shore, New York | 47 |

| ONOCHIE ONOBOGU | Bay Shore, New York | 29 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Bank Fraud | VERBELLE WILLIAMS CHUCK OSAKWE ONOCHIE ONOBOGU |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; and restitution |

| 2 | Bank Fraud | VERBELLE WILLIAMS CHUCK OSAKWE ONOCHIE ONOBOGU |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 3 | Bank Fraud | VERBELLE WILLIAMS CHUCK OSAKWE ONOCHIE ONOBOGU |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

United States v. Paulette Gabbidon, et al.

| Defendant | Residence | Age |

|---|---|---|

| PAULETTE M. GABBIDON | Quincy, Massachusetts | 39 |

| JASON LEWIS | Unknown | 34 |

| JOYCE LEWIS | Elmsford, New York | 56 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Bank Fraud | PAULETTE M. GABBIDON JASON LEWIS JOYCE LEWIS |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 2 | Bank Fraud | PAULETTE M. GABBIDON JASON LEWIS JOYCE LEWIS |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 3 | Bank Fraud | PAULETTE M. GABBIDON JASON LEWIS JOYCE LEWIS |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 4 | Bank Fraud | PAULETTE M. GABBIDON JASON LEWIS JOYCE LEWIS |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 5 | Bank Fraud | PAULETTE M. GABBIDON JASON LEWIS |

30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

United States v. Orit Tuil, et al.

| Defendant | Residence | Age |

|---|---|---|

| ORIT TUIL | Queens, New York | 39 |

| ANNETTE SHERESHEVSKY FONTE | Westbury, New York | 28 |

| DARLENE RITTER | Brooklyn, New York | 45 |

| NIR ZEER | Staten Island, New York | 30 |

| JOAN POWELL | Elmont, New York | 46 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Wire Fraud | ORIT TUIL ANNETTE SHERESHEVSKY FONTE DARLENE RITTER NIR ZEER JOAN POWELL |

30 years in prison; fine of $1,000,000 or twice the gross gain or loss; and restitution |

United States v. Yevgeny Komar and Joseph Patton

| Defendant | Residence | Age |

|---|---|---|

| YEVGENY KOMAR | Brooklyn, New York | 42 |

| JOSEPH PATTON | Stuart, Florida | 40 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Wire Fraud | YEVGENY KOMAR JOSEPH T. PATTON | 20 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

| 2 | Bank Fraud | YEVGENY KOMAR | 30 years in prison; fine of $250,000 or twice the gross gain or loss; and restitution |

United States v. Deanyon Ross

| Defendant | Residence | Age |

|---|---|---|

| DEANYON ROSS | Brooklyn, New York | 43 |

| Ct | Charge | Defendants | Maximum Penalties |

|---|---|---|---|

| 1 | Conspiracy to Commit Bank Fraud and Wire Fraud | DEANYON ROSS | 30 years in prison; fine of $1,000,000 or twice the gross gain or loss; and restitution |