New Data shows 2,399 foreclosures in Erie County. Senators unveil new law that will help protect homeowners and curb property values from plummeting

NEW YORK, NY – January 27, 2010 – (RealEstateRama) — Senator Jeff Klein (D-34th Senate District), Senator William Stachowski (D-58th Senate District) and Senator Antoine Thompson (D-60th Senate District) were joined by officials from the Town of Cheektowaga and City of Buffalo, housing group representatives from HomeFront, WestSide Neighborhood Housing Services, West New York Law Center, AmeriCorps and Old First Ward presented new data Wednesday showing the impact of neglected foreclosed properties in Erie County and announced a new New York State law that will help save neighborhoods across the state.![]()

Klein, Stachowski and Thompson unveiled the new data in light of the recently signed, first in the nation, comprehensive foreclosure law going into effect this year. In December 2009, Governor Paterson signed legislation authored by Klein, which created more opportunities for homeowners to gain access to the courts, implemented protections against loan modification scams, broadened tenants’ rights during the foreclosure process and obligated lending institutions to maintain foreclosed, Real Estate Owned (REO) properties that receive a judgment of foreclosure as well as the properties they already own.

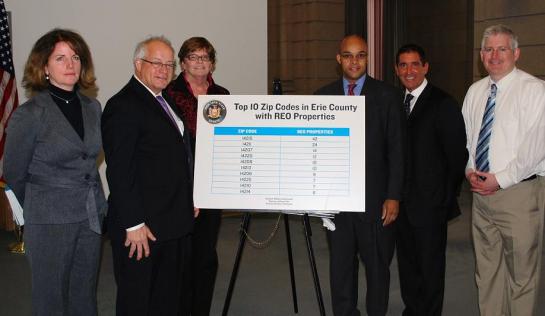

According to the Mayor of Buffalo’s Anti Flipping Task Force, 2,399 homes went into foreclosure in Erie County in 2009, which is in addition to the 178 homes which are currently owned by banks. In 2008, Buffalo officials sued 37 banks, claiming they were responsible for the deterioration of at least 57 abandoned homes. Five of the banks have entered into settlements of the lawsuits. Studies show that homeowners living near foreclosed properties see their own property values decrease $7,500 on average per each foreclosed home in the vicinity.

“This foreclosure crisis is now a neighborhood crisis, as the banks’ failure to maintain these properties increases the likelihood of drugs and crime on our community streets and decreases the value of homes,” said Senator Klein. “We desperately needed a law that protects our homeowners and neighborhoods and now we have one. Banks beware—New York State will no longer allow you to let foreclosed homes fall apart and become dangerous eye sores across our communities.”

Under the new law, as of April 15th, banks will be responsible for maintaining bank owned properties as well as all other properties after a judgment of foreclosure and sale has been entered. Banks will be held responsible until the ownership of the property is transferred to another owner Banks must maintain the property in compliance with the New York State Property Maintenance Code. If a tenant lives in the home, banks must also keep the property in a safe and habitable condition.

“In Erie County, you can plainly see just how important it is for banks to maintain foreclosed properties,” said Senator Stachowski. “If they fail in that task, the inevitable deterioration of the property will bring down the value of that house and the entire neighborhood as well. I want to thank Senator Klein for spearheading this important legislation forcing banks to maintain foreclosed properties.”

“I would like to congratulate Senator Klein for the passage of this much needed foreclosure legislation,” said Senator Thompson. “Requiring lending institutions to maintain foreclosed properties will help cut down the time between foreclosure and sale and also encourage people to buy these homes because they have been maintained and were not allowed to fall into disrepair.”

The law also states that the municipality in which the property is located may enforce the obligation as well as any tenant, a board of managers of a condominium or a homeowners association.

“In the unfortunate event of foreclosure, we must have assurances that the banks taking over ownership of these homes will properly maintain them. We cannot allow these properties to bring down the value of our neighborhoods,” said Cheektowaga Supervisor Mary F. Holtz.

“We applaud these Senators and the Governor for passing legislation that is critical to the health and stability of Buffalo and Erie County neighborhoods which are adversely affected by foreclosures. Now, when lenders go as far as obtaining a judgment of foreclosure, they must also assume responsibility for maintaining these properties. This was accomplished in spite of strong opposition from special interests but the cost, danger and blight associated with deteriorating houses will no longer be borne by hard-working neighbors and taxpayers,” said Kathleen Lynch, Supervising Attorney with West New York Law Center and Coordinator of the Mayor’s Anti-Flipping Task Force.

“Most of our housing stock in the city was built at the turn of the last century. Many of our neighborhoods are already struggling with vacancy and abandonment problems triggered by the economic exodus of the last thirty years. When you add what we call a ‘hanging foreclosure’ to that mix, you create a triple threat – a deteriorating structure, a former occupant who is now homeless, and a property that is extremely difficult to transfer to new owners, no matter how interested, capable or qualified they are. The maintenance provision at least makes sure that the property will be properly cared, and perhaps help the lender see the need to resell it as soon as possible,” said Laura Kelly, Executive Director of Old First Ward.