After receiving the preliminary report of the New York State Commission on Property Tax Relief, Governor David A. Paterson announced today that he is accepting the Commission’s principal recommendation and plans to introduce school property tax cap legislation to address the unsustainable growth in property taxes. The cap would apply to all school districts outside the “Big Five” cities (New York City, Buffalo, Rochester, Syracuse and Yonkers).

New York is a premier destination for individuals, families and entrepreneurs, but the state’s rising tax burden has impacted its ability to retain young families, seniors and businesses – especially in the face of a national economic downturn.

“The growth rate of property taxes in this state is unsustainable, especially for the elderly, working families and small businesses just starting out,” Governor Paterson said. “All of us understand that the cap is a blunt instrument, but it is needed to force hard choices and to address the fact that New York’s local tax burden is the highest in the nation. No matter what else happens, the choice of raising property taxes above a capped amount without voter approval is not an option. I thank the Commission and Chairman Thomas Suozzi for their diligence over the past four months, and now it is time for the leadership of this state to act.”

“By controlling the growth of the tax burden, we will be able to reduce voter anger over school taxes and redirect New Yorkers’ attention where it belongs – on the quality of our schools.” said Nassau County Executive Thomas Suozzi, the Chairman of the Commission.

“The question now becomes one of whether state government is up to this challenge,” Governor Paterson said. “The public has spoken clearly. Throughout our state, from young couples to seniors to business owners, the call is the same: people are demanding an end to ever-escalating property taxes. This trend not only threatens our quality of life, but our very ability to remain New Yorkers. I will work diligently with the Legislature to enact this cap. As the state and the nation head further into an economic downturn it is even more incumbent on us to alleviate our tax burden and we must also answer a critical question: Are we in public office willing to listen to those who we serve and take action, or will we delay action simply because it requires hard choices? I believe we must take action.”

The Preliminary Report highlights a number of key facts:

- New York State’s local taxes are the highest in America – 79% above the national average.

- Outside of New York City, 62% of property taxes are school property taxes.

- In terms of tax rate, nine of the top ten counties highest taxed counties in the nation are in Upstate New York. They are Wayne, Niagara, Monroe, Erie, Chautauqua, Onondaga, Cayuga, Chemung and Schenectady Counties.

- In terms of amount of taxes per household, Nassau, Westchester and Rockland Counties are in the nation’s top ten.

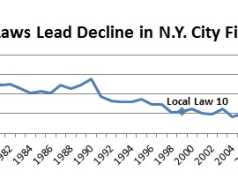

- Property tax levies are rising at more than twice the rate of inflation and salary growth.

Governor Paterson’s Proposed Legislation

The bill being submitted today by Governor Paterson generally mirrors the property tax cap proposal recommended by the Commission. In particular, the bill:

- establishes a “cap” on school property tax levy increases of 4% or 120% of CPI, whichever is less;

- requires at least 55% of voters to approve any tax levy over the cap, and increases that “supermajority” requirement to 60% if the school district is receiving an increase in State education funding of 5% or more;

- provides that if the proposal is rejected by the voters, the levy increase reverts back to the cap of 4% or 120% of CPI, whichever is less

- authorizes voters to place an “underride” proposal on the ballot if they wish to adopt a tax levy increase of less than the cap (or no increase at all); and

- provides an incentive for school districts to propose increases of less than the cap, by providing for the “banking” of unused levy growth amounts.

- preserves the right of all school district residents to vote every year – even if the board proposes a levy increase of less than 4%.

The Governor’s proposed legislation differs from the Commission’s recommendations in one significant way – by preserving the right school district residents to vote on proposed levy increases of less than the 4% cap. Under the Commission’s proposal, school boards are authorized to adopt levy increases up to the cap without seeking voter approval. The Governor’s proposed legislation preserves the existing right of residents to vote in these circumstances, thereby assuring that all levy increases are subject to voter approval.

Commission’s Principal Recommendation

The principal recommendation of the Commission’s Preliminary Report issued formally today is a school property tax cap to address the unsustainable growth in property taxes. The Commission recommends a cap on the growth of school property tax levies at 4% or 120% of the Consumer Price Index (CPI)), whichever is less. The proposed cap is set at a level that allows for reasonable growth of school expenses, while encouraging new construction and protecting capital expenditures already approved by voters.

The property tax cap would put voters in control of their school taxes. Voters could choose to levy more than the cap by “overriding” the cap at the ballot box. A vote by at least 55% of the voters would be required to override the cap. If a school district has received a 5% or greater increase in state aid, 60% of the voters would be required to override the cap.

Alternatively, if voters decide to levy less taxes, they could enact an “underride” of the cap. As an incentive to save tax capacity for future years, in school districts where the maximum levy growth permitted under the cap is not used in a given year, the unused portion would be “banked” and may be used in any future year to increase the levy by up to 1½ percent.

Other Recommendations

The Commission’s report also recommends that a STAR (School Tax Relief Program) “circuit breaker” be enacted, but only after a cap is put into place. The STAR circuit breaker would provide targeted relief to individual taxpayers based on income and ability to pay. An income tax credit would be provided for a percentage of property taxes paid when the taxes exceed a percentage of the owners’ income. The Commission believes that it would be unwise for the state to adopt a circuit breaker without addressing the core problem – the overall growth of property taxes – with a property tax cap.

Also included in the report are several recommendations to address the root causes of high property taxes. The Commission recommends providing school districts and local governments with relief from costly state mandates that, in turn, increase the property tax burden. Also proposed are several measures to reduce local costs that, again, are passed onto property owners.

Thomas Suozzi, Chairman of the Commission on Property Tax Relief said, “”I applaud the Governor for embracing a real solution to New York’s systemic property tax problem. The majority of the property taxes New Yorkers pay are school taxes, and there are only three ways to address the ever increasing cost burden of our educational system: decrease expenses (or decrease the rate of increase), increase state aid, or increase property taxes. New York’s property tax burden is unsustainable and regardless of any other factors, property tax increases above a capped amount must be limited.”

Paul Tokasz, Commission Member and former Majority Leader of the New York State Assembly, said “I commend the Governor for introducing legislation to stop the ever increasing growth in property taxes. It’s an honor to participate in this process on behalf of overburdened homeowners Upstate and statewide. Our charge was to ensure the quality of education wasn’t diminished, and yet we found a way to help provide property tax relief to New Yorkers. ”

Nicholas Pirro, Commission Member and former Onondaga County Executive said: “The input we received statewide, which is captured in our report, clearly demonstrates that New York’s local taxpayers are the most highly burdened in the nation. I support the Governor’s tax cap legislation, and it is my sincere hope that the members of the Legislature will act swiftly on this measure on behalf of our homeowners and small businesses struggling under the undue weight of property taxes.”

Kenneth Adams, President and CEO of The Business Council of New York State, “This report recognizes the damage New York’s high property taxes are doing to our economy. For many businesses in New York the property tax is the single largest tax they pay. This tax burden makes it difficult to grow and retain jobs in our state. The Governor’s support of a cap offers hope that New York can get the growth of property taxes under control.”

Mike Elmendorf, New York State Director of the National Federation of Independent Business, New York’s leading small business advocacy organization, said: “Today’s report by the Property Tax Cap Commission, outlining a realistic, achievable and effective plan to cap the growth of property taxes which have been sapping our competitiveness and driving people from their businesses and homes, is welcome news. New York’s highest in the nation property tax burden is a key reason why we also have the second highest cost of doing business in the country. This staggering tax burden is a double-whammy for small business owners, who get hit by the tax man at their business and in their homes. That’s why 83 percent of small business owners recently polled strongly supported a property tax cap–and why NFIB will be fighting for its enactment.”

Governor Paterson added, “I want to thank Chairman Tom Suozzi, Executive Director John Reid and all of the Commission Members and Special Advisors for their tireless efforts. Just four months ago, we established the Commission and provided them with a huge task, and they have returned to us with a list of serious recommendations to improve the quality of life across our state.”

Background on the Commission

The Commission on Property Tax Relief was established by Executive Order No. 22 in January 2008 to investigate and make recommendations regarding:

- Root causes of the high property tax burden, including unfunded mandates and local expenditures;

- Impacts of increased state aid and existing property tax relief programs;

- Effectiveness of property tax caps in other states and, potentially, in New York; and

- The most effective means to impose a limit on school property tax growth without adversely impacting the ability of school districts to provide a quality education to all students.

The Commission is charged with submitting its Final Report on December 1, 2008. Following the release of its Preliminary Report, the Commission will be inviting subsequent comments from the public and interested parties, in addition to conducting further research into the root causes of the property tax burden and other related areas.