November 15, 2007 — New York City Comptroller William C. Thompson, Jr. today announced that 2,100 individuals and families from across the tri-state region have called his Foreclosure Prevention Helpline to seek help to avoid losing their homes.

“Every day my office hears yet another story about a family facing the loss of its home,” Thompson said. “Foreclosure rates from subprime mortgages are reaching staggering rates. It’s estimated that approximately 15,000 families in the City are at risk of losing their homes by the end of this year and experts predict this number to increase significantly in 2008. These pending foreclosures not only will close the doors of homes and opportunities for thousands of New Yorkers, but will adversely impact our neighborhoods as a whole.”

Over the last eight months, Thompson has focused on helping New Yorkers address foreclosure issues. Among his initiatives:

- On April 26, Thompson unveiled a Foreclosure Prevention Helpline at (212) 669-4600. Since then, the Helpline has received 2,100 calls from New Yorkers and others from the broader tri-state region.The Helpline links callers with United States Department of Housing and Urban Development certified counselors in their specific neighborhoods. The Comptroller’s staff then monitors each case to ensure help is provided.Most of the calls have come from Queens. Thompson reported that 41.63 percent of cases are from Queens, 33.19 percent from Brooklyn, 12.23 percent from Staten Island, 9.6 percent from the Bronx, and 3.35 percent from Manhattan.

- The Comptroller is holding a series of Banking Days open to the public in each borough. Two were held in Harlem in May and at Hostos Community College in the Bronx in September. At the events, Comptroller’s staff provide information to improve financial literacy and assist New Yorkers with foreclosure questions.

- The Comptroller launched radio and television Public Service Announcements in late summer and early Fall to spread the message that help is available. You can view the television ad at www.comptroller.nyc.gov.

- Thompson published a Foreclosure Prevention Guide. The guide provides necessary information about mortgages, how to avoid foreclosures, and foreclosure prevention counseling services. The guide is available at www.comptroller.nyc.gov, or by calling (212) 669-4600.

- The Comptroller launched the citywide “Save Our Homes” initiatives. Through this initiative, Thompson’s office is working with labor, clergy and neighborhood organizations to highlight the crisis and offer assistance to New Yorkers. Over the next few months, Thompson is visiting religious institutions to talk about the issue and distributes thousands of guides.

“We plan to highlight the issue and distribute a prevention guide in churches identifying ways to prevent foreclosure and listing vital resources for people in their neighborhoods, in the city, and in the state,” Thompson said. “There is an urgent need for this crisis to be rapidly addressed at many levels, because it affects every one of us, if not a family member than a friend or a neighbor.”

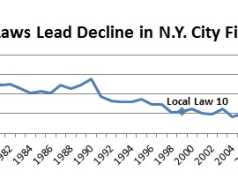

All signs point to a worsening of the subprime crisis and its impact on New York City. According to the Neighborhood Economic Development Advocacy Project (NEDAP), New York City lis pendens filings (the formal notices that start the foreclosure process) have steadily risen over the last four years – from 6,685 citywide in 2004 to 11,029 in 2007 (as of October 15). That number is expected to near15,000 by year’s end.

Thompson pointed out that many callers indicate that they initially entered into Adjustable Rate Mortgage (ARM) loans with low initial payments and manageable monthly payments. When the interest rate and monthly payment changes take effect, usually within two years, the ARM interest rate can increase drastically and continue to climb by more than one percent and up to a maximum of 16.100% throughout the terms of the loans in some instances. As a result, monthly payments balloon hundreds of dollars, costing thousands of dollars more each year.

“This is a crisis that affects every one of us and we must work together, and reach out to people in any way we can,” Thompson said. “If we work together, we can offer options and resources for homeowners and future borrowers who may become victims of subprime loans. We must do everything we can to preserve homeownership in the City.”